Navigating the world of currency can feel like embarking on a grand adventure. Each country boasts its own unique form of money, a tangible representation of its history, culture, and economic identity. From the familiar dollar to the more exotic sounding zloty, understanding the different currencies used around the globe offers a fascinating glimpse into the diverse tapestry of international finance. It’s more than just numbers and symbols; it’s a key to unlocking the stories behind each nation’s economic journey. Imagine, for example, the intricacies of exchanging currency before visiting a new place, researching the best rates, and feeling that thrill of preparedness as you convert your home currency into the local tender.

Currency Exploration: A Global Overview

Delving into the world of currencies, one quickly realizes that it is far more than just a means of transaction. It’s a reflection of a nation’s sovereignty and economic policies. For instance, the United States Dollar (USD) holds a significant position as a global reserve currency, influencing international trade and finance. Its widespread acceptance and stability make it a key player in the global market. On the other hand, currencies like the Japanese Yen (JPY) and the Euro (EUR) also play crucial roles in regional and international commerce. Understanding the relative strengths and weaknesses of these major currencies is paramount for anyone involved in international business or investment.

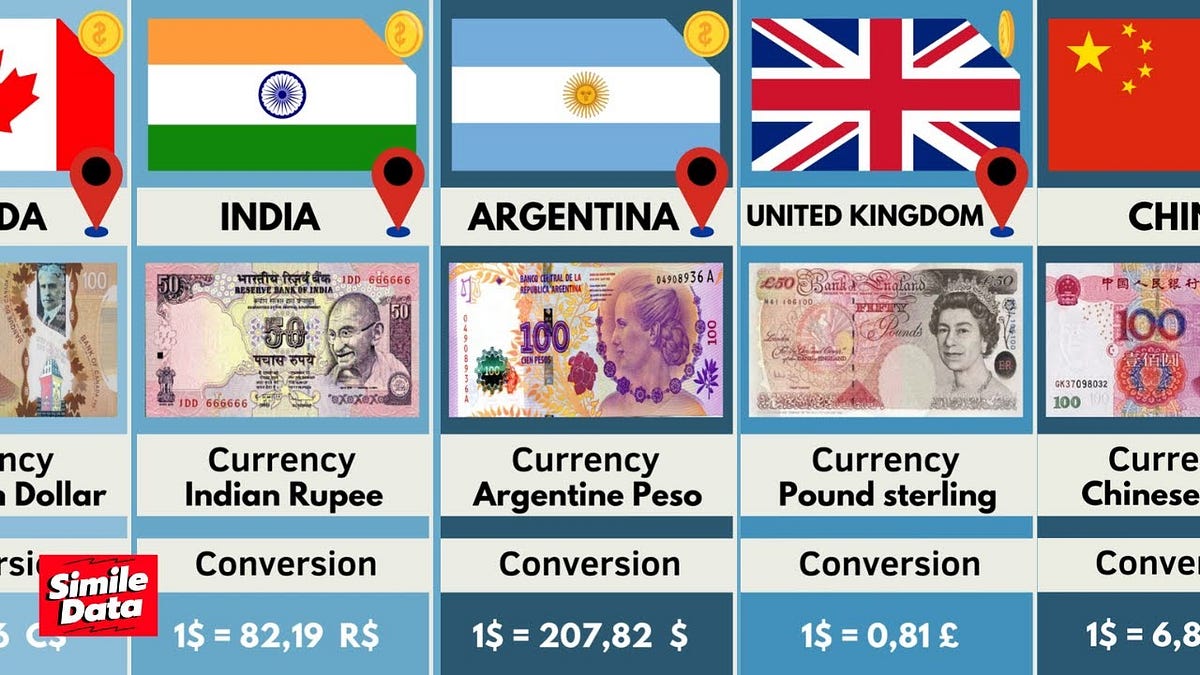

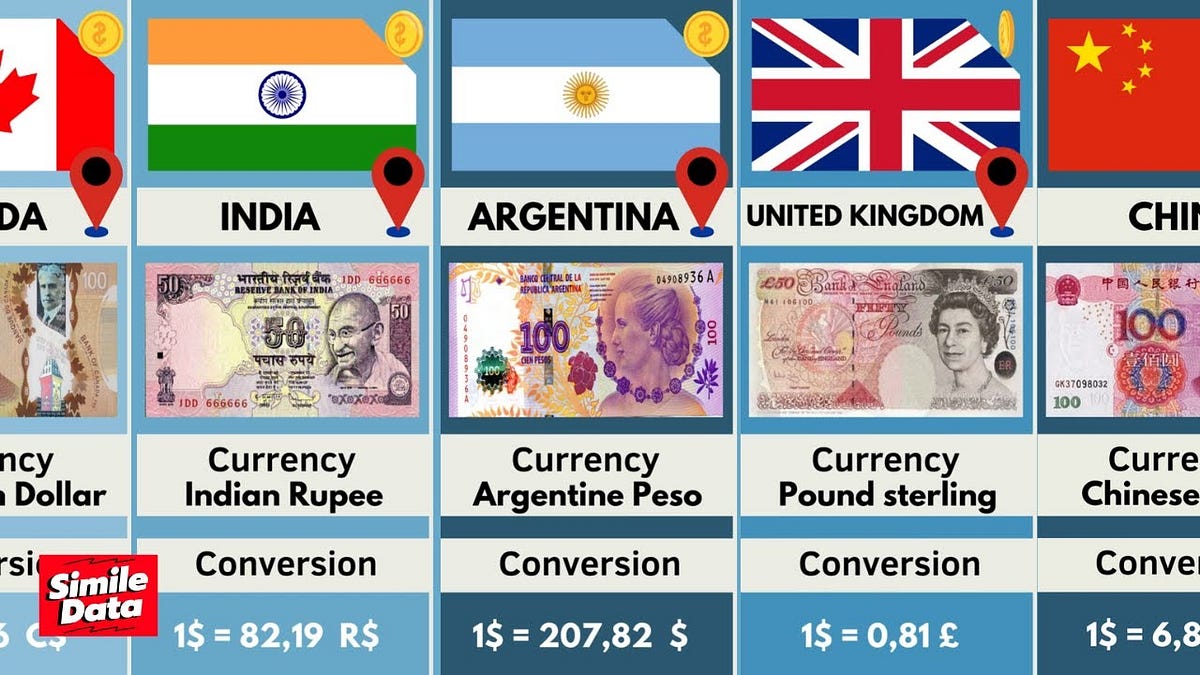

Consider the complexities of exchange rates. These rates fluctuate constantly, influenced by a multitude of factors including inflation, interest rates, political stability, and overall economic performance. A strong currency can make imports cheaper and exports more expensive, while a weak currency can have the opposite effect. Governments and central banks often intervene in currency markets to manage exchange rates, aiming to maintain economic stability and competitiveness. The management of currency values is a delicate balancing act, requiring careful consideration of both domestic and international economic conditions.

Beyond the major players, there are countless other currencies used in smaller economies. Each of these currencies tells a story, reflecting the unique challenges and opportunities faced by the respective country. Some currencies are pegged to the US Dollar or other major currencies, providing stability and reducing exchange rate volatility. Others float freely, their value determined by market forces. The choice of exchange rate regime is a critical decision for any country, impacting its trade balance, inflation, and overall economic growth.

Furthermore, the design of banknotes and coins provides insights into a nation’s history and culture. Images of national heroes, landmarks, and iconic symbols often adorn the currency, serving as reminders of the country’s identity and values. The materials used in the production of currency also vary widely, from traditional paper to more durable polymers. Security features are constantly evolving to combat counterfeiting, ensuring the integrity of the currency and maintaining public trust.

The evolution of currency is also fascinating. Throughout history, various forms of money have been used, from precious metals to commodities to fiat currency. The advent of digital currencies like Bitcoin and Ethereum has added another layer of complexity, challenging traditional notions of money and finance. While digital currencies offer potential benefits such as lower transaction costs and increased accessibility, they also pose challenges related to regulation, security, and volatility. The future of currency is likely to be a mix of traditional and digital forms, each playing a role in the global economy.

Country Specifics: Currencies and Notations

Looking closer at specific examples, the diversity in currency systems becomes even more apparent. Consider the Eurozone, where nineteen countries share a single currency, the Euro. This monetary union has facilitated trade and investment within the region, but it has also presented challenges related to economic coordination and fiscal policy. The European Central Bank (ECB) plays a crucial role in managing the Euro, setting interest rates and overseeing the banking system. The success of the Eurozone depends on the ability of member countries to maintain fiscal discipline and coordinate their economic policies.

In contrast, countries like the United Kingdom have chosen to maintain their own currencies, such as the Pound Sterling (GBP). The decision to remain outside the Eurozone reflects a desire to maintain control over monetary policy and exchange rates. The UK’s economy is heavily reliant on international trade, and the value of the Pound Sterling can have a significant impact on its competitiveness. The Bank of England is responsible for managing the Pound Sterling, aiming to maintain price stability and support economic growth.

In developing countries, currency management often presents unique challenges. Many developing countries rely heavily on exports of commodities, and fluctuations in commodity prices can have a significant impact on their currency values. Exchange rate volatility can also be a major problem, making it difficult for businesses to plan and invest. Governments in developing countries often intervene in currency markets to manage exchange rates, but these interventions can be costly and may not always be effective.

Currency notation is another important aspect of understanding international finance. Each currency has a unique three-letter code, such as USD for US Dollar or EUR for Euro. These codes are used in financial transactions and reporting to identify the specific currency being used. Understanding currency notation is essential for anyone involved in international trade or investment.

Furthermore, the availability of foreign exchange services varies widely around the world. In some countries, it is easy to exchange currency at banks, airports, and exchange bureaus. In other countries, it may be more difficult to find reliable and affordable foreign exchange services. It is important to research the availability of foreign exchange services before traveling to a new country.

Finally, the rise of mobile payments and digital wallets is transforming the way people use currency. Mobile payments allow people to make transactions using their smartphones, while digital wallets store electronic versions of credit cards and other payment methods. These technologies are making it easier and more convenient to make payments, both domestically and internationally. As mobile payments and digital wallets become more widespread, they are likely to have a significant impact on the future of currency. The integration of these technologies with existing currency systems is an ongoing process, and the long-term implications are still uncertain. However, it is clear that technology is playing an increasingly important role in shaping the world of money and finance.

If you are searching about List of Currency in World by Country | PDF | Numismatics you’ve visit to the right page. We have 5 Pictures about List of Currency in World by Country | PDF | Numismatics like List of Currency in World by Country | PDF | Numismatics, Currency of All Countries — Countries Currency List — Money From and also List of Countries and Their Currency | PDF | Renminbi | Australian Dollar. Read more:

List Of Currency In World By Country | PDF | Numismatics

www.scribd.com

Currency Of All Countries — Countries Currency List — Money From

medium.com

List Of Countries And Their Currency | PDF | Renminbi | Australian Dollar

www.scribd.com

Currency List Of All Countries With Symbols Excel – Printable Templates

read.cholonautas.edu.pe

List Of Participating Countries, Currencies And Currency Notation

www.researchgate.net

Currency of all countries — countries currency list — money from. List of currency in world by country. List of countries and their currency