Alright, lemme break this down for y’all. We gotta talk ’bout money, honey. Specifically, them dollars – Canadian AND U.S.! See, for us folks, making sure our money stretches is *everything*. We ain’t got dollars to be throwin’ away on bad exchange rates, ya dig? We gotta be smart, strategic, and know how to get the most outta every single cent.

So, the game ain’t always simple, but understanding the basics will definitely keep you from gettin’ fleeced. We gonna look at this whole dollar situation, how they play together, and how *you* can make sure *you* the one comin’ out on top. No more letting the system bamboozle us. We gon’ learn the rules, and then we gon’ play the game better than they ever expected. Let’s get into it, ya heard?

Understanding the Exchange Rate Jive

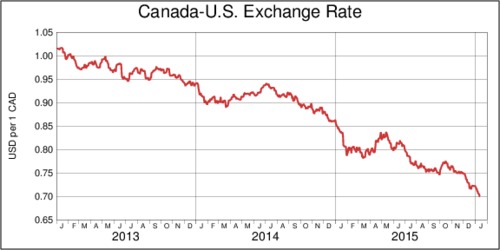

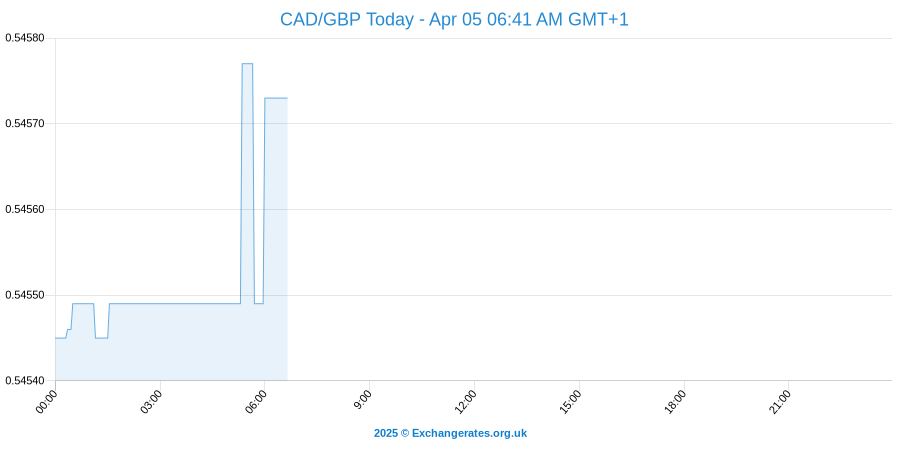

First thing’s first, gotta understand what the exchange rate *is*. Think of it like this: it’s the price of one country’s money in terms of another. So, if the exchange rate is, say, 1.30 Canadian dollars (CAD) per 1 U.S. dollar (USD), that means you need 1.30 Canadian dollars to buy one U.S. dollar. This number ain’t set in stone, though. It dances around based on all sorts of things – what’s goin’ on in the economies of both countries, interest rates, even just how folks *feel* about the money situation. That’s why you see it changing all the time. And that’s also why you gotta pay attention!

Now, why is this important for *us*? Well, if you’re traveling, sending money back home to family, or even buying stuff online from another country, that exchange rate is gonna hit you right in the wallet. A bad rate can mean you’re paying way more than you should be. And trust, nobody got time for that. We need to be mindful of these rates. They fluctuate based on several factors – inflation rates, interest rates, and geopolitical stability. Staying informed is key, and don’t be afraid to do your research!

See, a strong U.S. dollar (meaning it takes fewer CAD to buy one USD) is good if you’re heading up to Canada on vacation and want your money to stretch further. But if you’re sending money *from* the U.S. to Canada, you want that U.S. dollar to be a little weaker, so your folks up north get more Canadian dollars for every U.S. dollar you send. Get it? It’s all about perspective and understanding which way the wind is blowin’.

Hunting for the Best Exchange Rates

Alright, so now you know the basics. But how do you actually *find* the best exchange rate? This ain’t about just walking into the first bank or exchange place you see. That’s how they get you! You gotta shop around, just like you would for anything else.

Banks are an option, of course. But they often have higher fees and not-so-great exchange rates. Think of it like buying gas at the fancy gas station right off the highway – convenient, but pricey. Credit unions can sometimes offer better rates, so check them out if you’re a member. Online exchange services are another possibility, and often have competitive rates. But be careful! Do your research and make sure they’re legit before you send any money. You don’t want to get scammed.

Another trick? Keep an eye on the exchange rate trends. Is it generally going up or down? If you don’t need to exchange your money *right now*, it might be worth waiting a bit to see if the rate moves in your favor. Think of it like waiting for something to go on sale. Patience can pay off. Set up alerts on your phone for exchange rates. Google finance and several financial websites allow this.

Remember, small differences in the exchange rate can add up to big savings, especially if you’re exchanging a large amount of money. Every fraction of a cent matters. It might not seem like much at first glance, but those pennies can turn into dollars, and those dollars can turn into opportunities. Don’t underestimate the power of a little bit of research and comparison shopping.

Avoiding Hidden Fees and Charges

Now, listen close, ’cause this is where they really try to get you. It ain’t just about the exchange rate itself. You gotta watch out for those hidden fees and charges. Banks and exchange services often tack on extra fees, and they might not always be upfront about them. They might call it a “service fee,” a “commission,” or some other fancy name. But it all means the same thing: they’re taking more of your money.

Always ask about *all* the fees before you agree to anything. And don’t be afraid to negotiate. If you’re exchanging a large amount of money, you might be able to haggle for a better rate or lower fees. Remember, they want your business, so don’t be afraid to stand your ground. If one place won’t budge, walk away and try another. There are plenty of options out there.

Also, be careful about using credit cards for currency exchange. They often charge hefty fees for foreign transactions, and the exchange rate might not be the best. Cash is often king, but even then, be wary of ATMs in foreign countries, as they can also charge high fees. Plan ahead and try to exchange your money before you travel.

Read the fine print, people! Don’t just assume that everything is on the up-and-up. Ask questions, compare prices, and don’t be afraid to walk away if something doesn’t feel right. Your money is hard-earned, and you deserve to keep as much of it as possible.

Tools and Resources for the Savvy Exchanger

Luckily, we live in the information age. There are tons of tools and resources out there to help you get the best exchange rates. Websites like Google Finance, XE.com, and others offer up-to-date exchange rates and historical data. You can use these to track the exchange rate over time and get a sense of whether it’s a good time to buy or sell.

There are also apps that can help you compare exchange rates and find the best deals. Some of these apps even let you set up alerts so you’ll be notified when the exchange rate reaches a certain level. These apps can also calculate conversion between different currencies.

Don’t be afraid to ask for advice from friends and family who have experience with currency exchange. They might have some tips and tricks that you haven’t thought of. And remember, knowledge is power. The more you know about the exchange rate, the better equipped you’ll be to make smart decisions.

Financial literacy is key. Take some time to learn about personal finance and investing. Understanding how money works is crucial for building wealth and securing your financial future. Don’t let the financial system intimidate you. It’s designed to be understood, and with a little effort, you can master it.

So there you have it. A few tips and tricks to help you navigate the world of currency exchange. Remember, it’s all about being informed, being patient, and being willing to shop around. Don’t let those sneaky fees and charges get you down. Stay vigilant, stay informed, and stay in control of your money. Now go on out there and get the best deals you can find! We out here grinding for every dollar and cent, and we deserve to keep as much of it as possible. Peace!

If you are looking for Canadian to us dollar currency converter – trackerlopez you’ve came to the right place. We have 5 Pics about Canadian to us dollar currency converter – trackerlopez like Canadian Us Dollars Converter – pigtrust, Solved Starting with 2,000,000 Canadian dollars, convert | Chegg.com and also Convert Us Dollars To Canadian Dollars Pounds Egyptian | Venzero. Here it is:

Canadian To Us Dollar Currency Converter – Trackerlopez

trackerlopez.weebly.com

Canadian To Us Dollar Currency Converter – Trackerlopez

trackerlopez.weebly.com

Convert Us Dollars To Canadian Dollars Pounds Egyptian | Venzero

venzero.com

Solved Starting With 2,000,000 Canadian Dollars, Convert | Chegg.com

www.chegg.com

Canadian Us Dollars Converter – Pigtrust

pigtrust.weebly.com

Canadian to us dollar currency converter. Convert us dollars to canadian dollars pounds egyptian. Canadian us dollars converter